All About Paul B Insurance Medicare Agent Huntington

Wiki Article

The Definitive Guide to Paul B Insurance Medicare Insurance Program Huntington

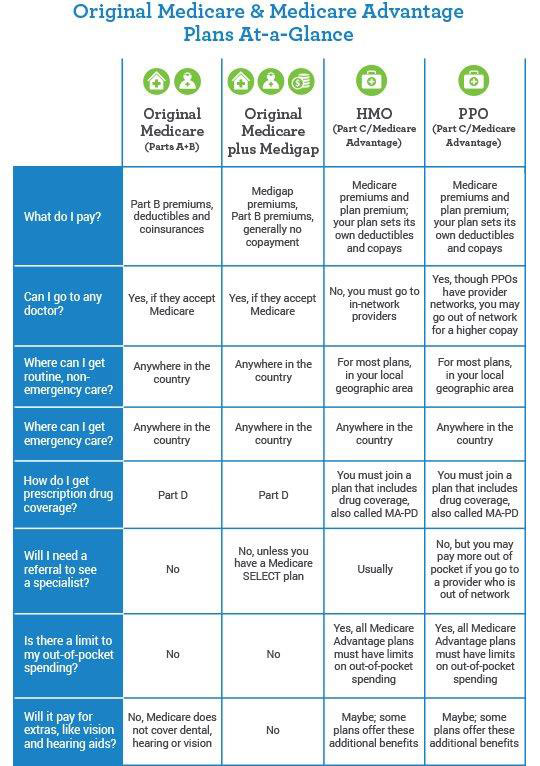

A: Initial Medicare, additionally known as standard Medicare, includes Part An and Component B. It permits beneficiaries to go to any type of doctor or health center that approves Medicare, anywhere in the United States.

Attempting to determine which kind of Medicare plan is right for you? We're here to assist. Discover more about the different components of Medicare and kinds of medical care strategies readily available to you, consisting of HMO, PPO, SNP strategies as well as even more.

Normally, the different components of Medicare help cover particular services.

It is often called Conventional Medicare or Fee-for-Service (FFS) Medicare. Under Initial Medicare, the government pays directly for the wellness treatment solutions you obtain. You can see any physician and also health center that takes Medicare (as well as the majority of do) anywhere in the country. In Original Medicare: You go straight to the physician or hospital when you need care.

Top Guidelines Of Paul B Insurance Medicare Insurance Program Huntington

It is very important to understand your Medicare insurance coverage options and also to select your insurance coverage meticulously. Exactly how you select to obtain your benefits and also that you get them from can impact your out-of-pocket costs and where you can get your treatment. In Original Medicare, you are covered to go to virtually all medical professionals and health centers in the country.

However, Medicare Advantage Plans can also offer extra benefits that Original Medicare does not cover, such as regular vision or oral care.

Formularies can differ by strategy, and also they might not all cover your needed medicines. Because of this, it is very important to assess offered protections when comparing Medicare Part D plans.

Prior to you enroll in a Medicare Benefit prepare it's important to recognize the following: Do all of your carriers (physicians, healthcare facilities, and so on) accept the plan? You have to have both Medicare Components An as well as B as well as stay in the service location for the strategy. You need to stay in the plan until the end of the schedule year (there are a couple of exceptions to this).

Some Ideas on Paul B Insurance Medicare Part D Huntington You Need To Know

A lot of Medicare drug strategies have an insurance coverage gap, additionally called the "donut hole." This implies that after individuals with Medicare, called recipients, and their plans have spent a specific amount of money for protected drugs, the beneficiary might need to pay higher prices out-of-pocket for prescription medicines. The coverage space is one phase of the Medicare Component D prescription medication insurance coverage cycle.

Understanding regarding Medicare can be a complicated task. However it does not have to be. HAP is below, aiding you understand the fundamentals of Medicare (Parts A, B, C and also D), the three major kinds of Medicare (Original, Medicare Advantage, as well as Supplemental), as well as the enrollment timeline all the means from authorizing to changing when a plan does not satisfy your needs.

People with Medicare have the option of getting their Medicare benefits with the typical Medicare program administered by the federal government or via a private Medicare Advantage strategy, such as an HMO or PPO. In Medicare Benefit, the federal government agreements with exclusive insurers to give Medicare advantages to enrollees.

The rebate has actually boosted substantially in the last numerous years, greater than doubling since 2018. Nearly all Medicare Benefit enrollees (99%) remain in plans that require previous authorization for some solutions, which is typically not used in standard Medicare. Medicare Benefit strategies additionally have actually specified networks of companies, as opposed to traditional Medicare.

4 Simple Techniques For Paul B Insurance Medicare Part D Huntington

Completely, consisting of those that do not pay a costs, the typical enrollment-weighted premium in 2023 is $15 each month, as well as standards $10 each month for simply the Component D section of covered benefits, substantially lower than the ordinary costs of $40 for stand-alone prescription medicine plan (PDP) costs in 2023.

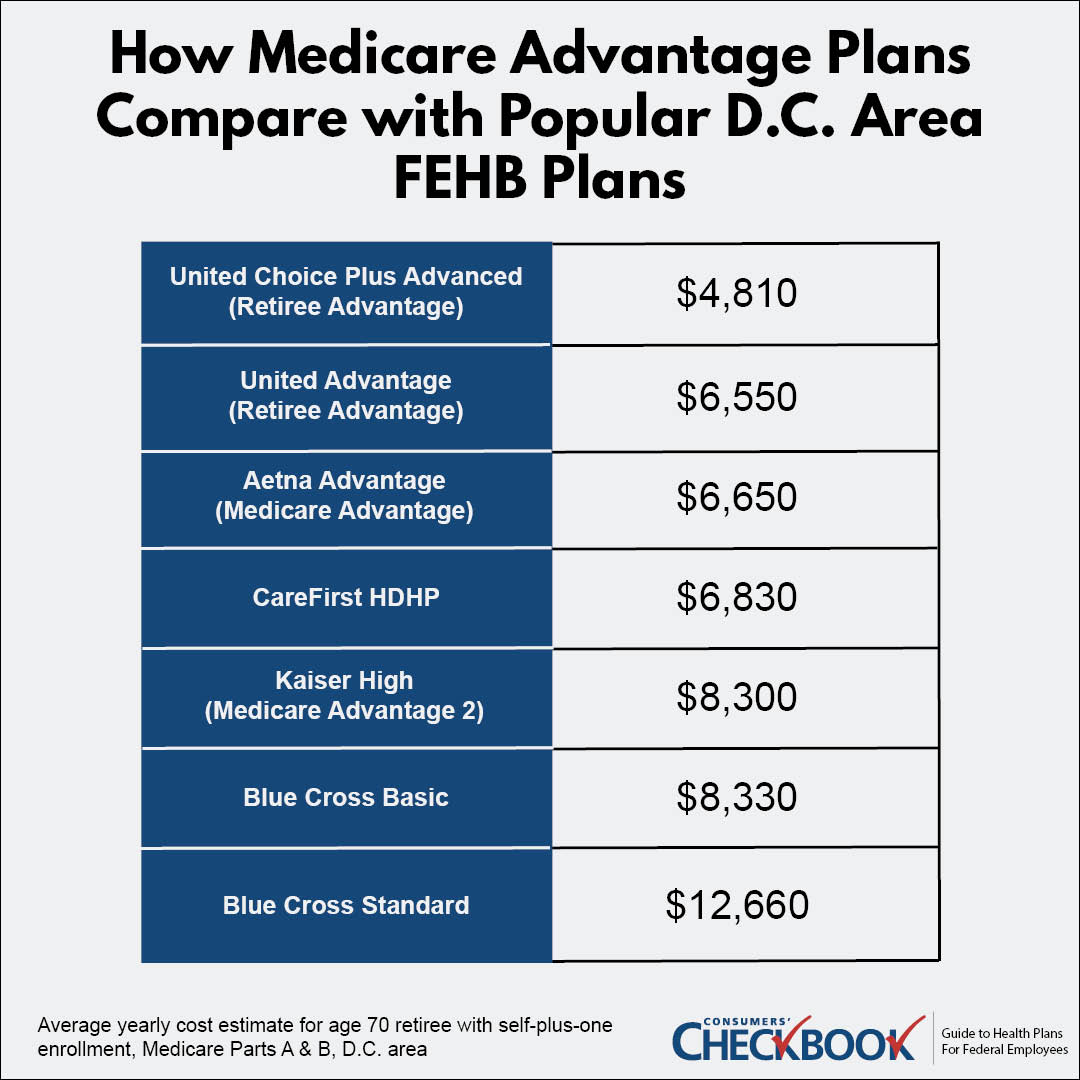

As strategy bids have decreased, the refund portion of plan repayments has raised, and plans are alloting a few of those discount bucks to reduce the component D section of the MA-PD costs. This fad adds to higher accessibility of zero-premium plans, which brings down ordinary premiums. Since 2011, federal law has actually needed Medicare Advantage prepares to offer an out-of-pocket restriction for solutions covered under Components An and B.

Whether a strategy has just an in-network cap or a cap for in- and out-of-network solutions relies on the sort of strategy. HMOs usually just cover services offered by in-network companies, whereas PPOs additionally cover services delivered by out-of-network service providers paul b insurance Medicare Supplement Agent huntington yet fee enrollees greater price sharing for this treatment. The dimension of Medicare Benefit provider networks for medical professionals and also hospitals vary greatly both throughout counties and also across strategies in the same region.

Paul B Insurance Medicare Agent Huntington Things To Know Before You Buy

a dental benefit may include preventative services only, such as cleanings or x-rays, or more extensive protection, such as crowns or dentures. Plans additionally vary in terms of expense sharing for numerous services and limitations on the number of solutions covered annually, numerous enforce an annual buck cap on the amount the strategy will pay toward covered service, as well as some have networks of oral providers recipients need to select from.

As of 2020, Medicare Advantage plans have actually been allowed to include telehealth benefits as component of the standard Medicare Component An and B advantage bundle beyond what was enabled under standard Medicare before the public health and wellness emergency situation. These benefits are taken into consideration "telehealth" in the number above, although their price may not be covered by either discounts or supplementary costs.

Prior consent is also needed for the bulk of enrollees for some added benefits (in strategies that offer these advantages), including thorough oral solutions, hearing as well as eye examinations, and transport. The number of enrollees in strategies that call for previous permission for one or even more solutions stayed around the very same from 2022 to 2023.

Report this wiki page